From Business Owner to Wealth Owner

A structured path to clarity, confidence, and financial independence.

- You’ve spent years building a valuable business.

- Now it’s time to make it work for you.

- Whether you’re two years or two months from exit, Adviso Wealth helps you convert business value into lasting personal wealth with clarity, structure, and peace of mind.

Most business owners aren’t ready even if they think they are

| Metric | Statistic | Supporting Text |

|---|---|---|

| Businesses that never sell | 70 % | Most exits fail due to poor planning or buyer mismatch. |

| Owner wealth trapped in business | 90 % | Wealth remains illiquid and unprotected without a plan. |

| Owners truly ready (financially + personally) | 25 % | Only one in four has integrated goals, taxes, and lifestyle planning. |

| Owners who regret their exit | 80 % | They focused on the sale, not the life and wealth that followed. |

The difference between financial freedom and frustration isn’t luck — it’s preparation. At Adviso Wealth, we help you prepare early, think holistically, and exit on your terms.

Why choose Adviso Wealth

You’ve built significant enterprise value but that doesn’t automatically translate into personal freedom.

Without a coordinated strategy:

- Taxes quietly erode proceeds.

- Advisors work in silos.

- Cash flow after exit feels uncertain.

- Identity and purpose questions go unanswered.

Adviso Wealth helps you connect every piece of your financial life business, personal, and emotional long before you sign the deal, so your next chapter begins with clarity and confidence.

How our process protects what you’ve built

Know What You’re Really Worth

Plan the Exit Before the Exit

Coordinate Every Advisor

Design Your Next Chapter

Know What You’re Really Worth

Plan the Exit Before the Exit

Coordinate Every Advisor

Design Your Next Chapter

Two paths to clarity and confidence

Choose the level of depth that fits where you are in your journey.

Deep Dive

8 Weeks to Clarity and Direction.

Business owners 2–5 years from exit who want answers and an actionable plan — without a long engagement.

- Business & Personal Readiness Dashboard

- 12-Month Action Roadmap

- Advisor Coordination Letter

- Hidden Wealth Leak Detector Diagnostic

- Business Readiness & Wealth Gap Report

- Estate & Legacy Overview

- Clarity on your numbers.

- Confidence in your next steps.

- Momentum to increase business and personal value.

Conversion Plan

6 Months to Complete Financial and Emotional Transition.

Owners within 6–24 months of exit — or recently sold — ready for a comprehensive transition.

- Comprehensive Wealth Conversion Plan

- After-Tax Exit Analysis (Asset vs Stock vs ESOP)

- Liquidity & Cash-Flow Plan

- Investment Alignment Strategy

- Insurance & Risk Review

- Post-Sale Operations Checklist

- Legacy & Gifting Blueprint

- Advisor Coordination Package

- Wealth Conversion Progress Tracker

- A complete transition roadmap — financial, emotional, and operational.

- Tax-efficient liquidity and investment structure.

- Confidence and peace of mind in your next chapter.

| Deep Dive | Conversion Plan | |

|---|---|---|

| Timeline | ~8 months | ~6 weeks |

| Meetings | 3 | 6 |

| Focus | Clarity & Direction | Comprehensive Transition |

| Ideal for | 2–5 years from exit | 0–24 months from exit / Recently sold |

| Key Deliverables | Dashboard, 12-Month Roadmap, Advisor Letter | Full Wealth Plan, Liquidity Roadmap, Legacy Blueprint |

| Outcome | Confidence & Momentum | Peace of Mind & Integration |

Both paths begin with a single step — a short introductory call to clarify your goals and decide which engagement is right for you.

Trusted by business owners navigating their next chapter

Why business owners choose Adviso Wealth

Independent & Fee-Only

Deep Expertise

Boutique Experience

Your next chapter deserves the same intention as your business

One conversation can clarify your path forward.

You’ve built something extraordinary. Let’s make it work for you.

Your business may be your life’s most valuable asset — the result of years of discipline, vision, and effort.

But as you look toward transition or exit, a single question often remains unanswered:

How do I turn what I’ve built into lasting financial independence and a purposeful next chapter?

Most Business Owners Aren’t Ready, Even If They Think They Are

Most owners overlook how their business value connects to personal wealth, taxes, investments, and the life they want after the sale.

A Cohesive Process for Clarity, Liquidity, and Direction

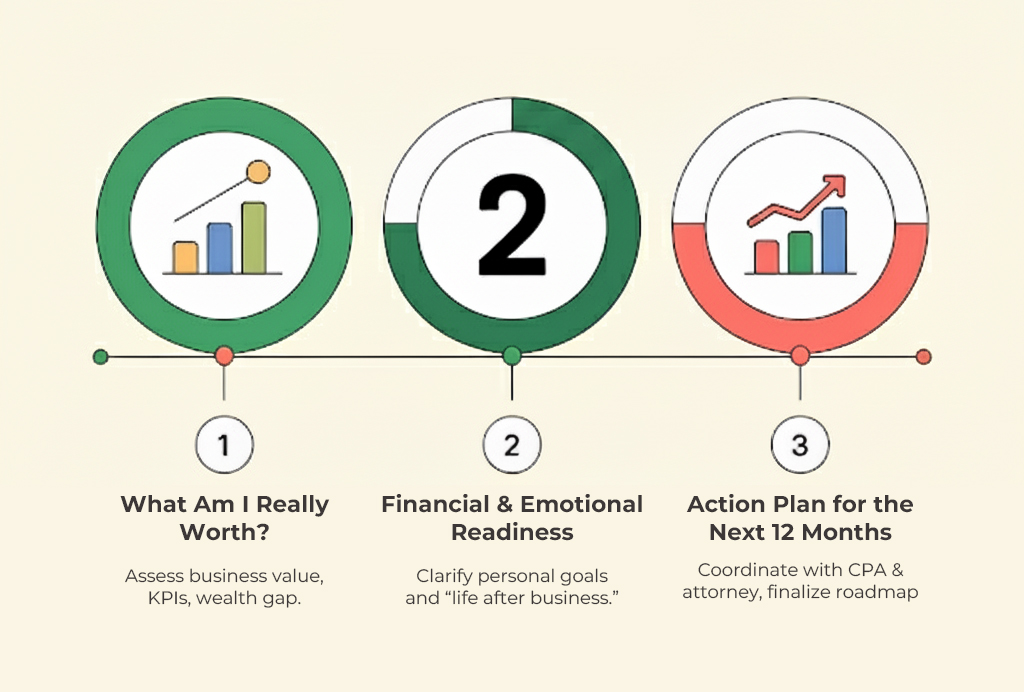

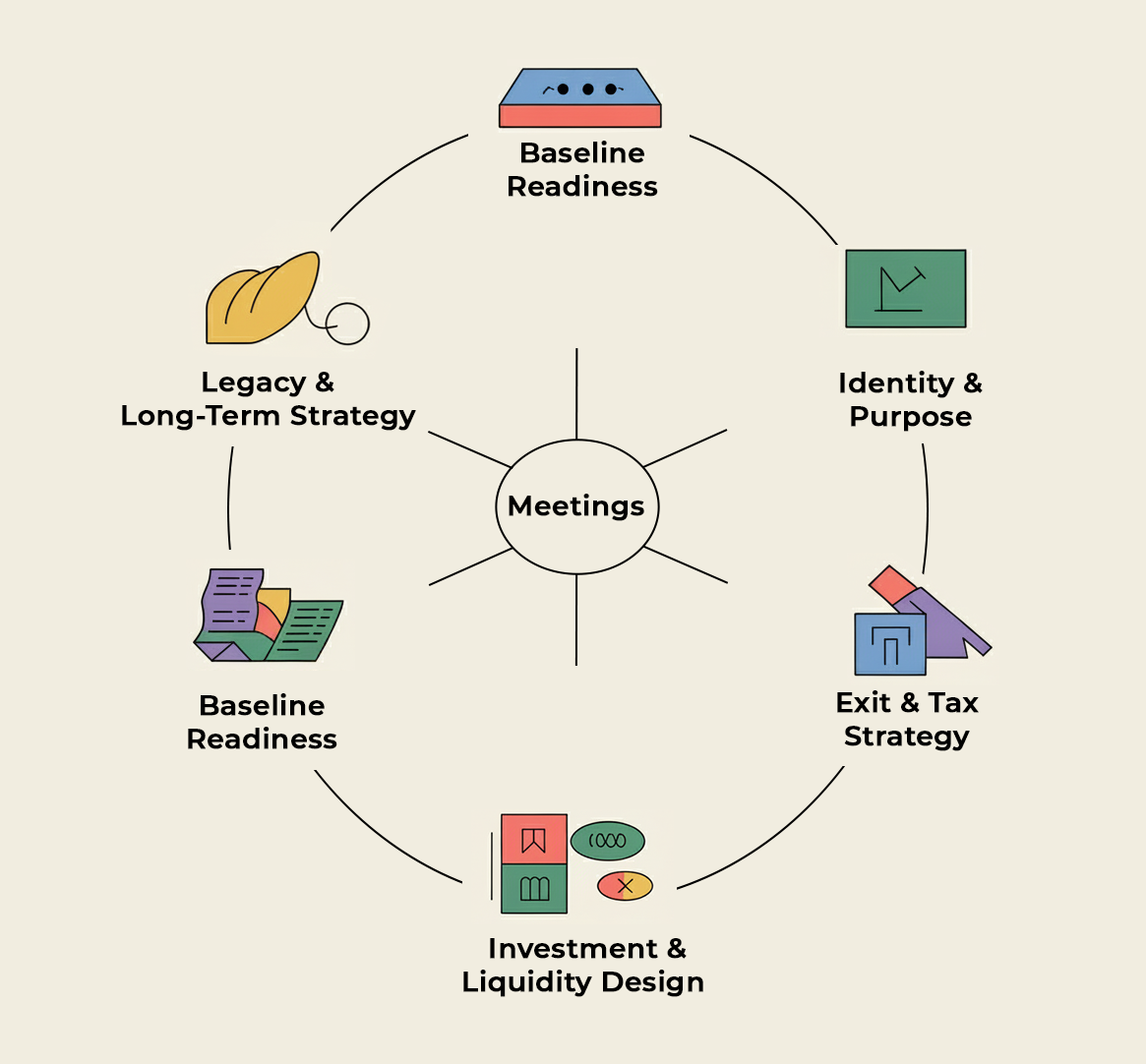

The Business Owner Wealth Deep Dive is a structured six-meeting engagement designed specifically for founders and business owners preparing for exit or liquidity events.

As a CFP®, CFA®, and CEPA®, I guide you through a process that aligns your business value, personal finances, and long-term goals. When your financial life is fully aligned, you’ll:

- Understand the true value of your business and what it means for your personal wealth.

- Know how much you need, what you can keep after exit, and how to protect your wealth

- Move forward with a clear, tax-efficient plan for managing your liquidity and investments.

- Feel confident, organized, and prepared, both financially and personally, for whatever comes next.

Most owners overlook how their business value connects to personal wealth, taxes, investments, and the life they want after the sale.

The Experience

- Private partnership — all work is done directly with me, not delegated.

- Virtual convenience — meetings conducted via secure video conference.

- Evidence-based planning and investing — grounded in academic research, not speculation.

Align personal wealth with business success

Build tax-efficient personal financial strategies

Prepare for growth, transition, or life beyond the business

My Story

I’m a first-generation immigrant, a mother, and a business owner. I understand the pressure of providing for your family, building something meaningful, and figuring it out as you go.

That’s why my work isn’t about products or commissions—it’s about helping business owners like you simplify complexity and make clear, confident financial decisions.

As a CFA®, CFP®, and CEPA®, I combine deep technical knowledge with a flat-fee process But more importantly, I bring real-world understanding. The numbers matter—but so do your goals, your family, and your peace of mind.